Table of Content

The HSBC MyHome product is no longer being offered to customers. Information is for the reference of existing MyHome customers only. Finance environmentally friendly personal products and services. To apply for a personal loan you must be a resident of Malta, and aged 18 or over. You must be registered for online banking to complete an online application form. Apply for a Home Improvement Loan using online banking and have the $200 negation fee waived.

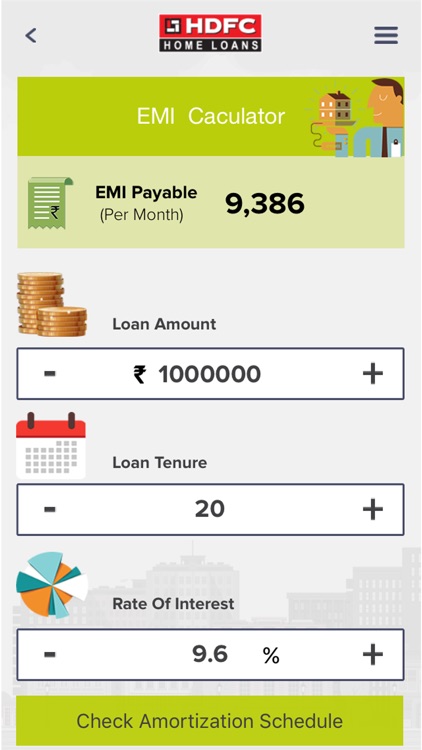

Creating a budget will give you an idea of how much you could afford to pay each month. Look at your income for the last three months and compare it to your spending over the same time. Keep in mind – the longer your loan term, the more interest you’ll pay overall.

Bank Accounts

For clients located outside of the U.S. - Our products and services are not specifically directed at individuals located in the European Union. Our U.S. representatives, as well as our public website, us.hsbc.com, provide products and services governed by U.S. laws and regulations. Our products and services, as well as their specific terms and conditions, are subject to change and may not be available in all territories or to all customers.

And are only available for properties located in the U.S. Discounts can be cancelled or are subject to change at any time and cannot be combined with any other offer or discount. Always know what you'll have to pay with fixed monthly repayments spread over 1 to 5 years for loans of £15,000 or less, or over 1 to 8 years for loans over £15,000. Keep in mind – if you have an existing mortgage, and take out a home loan, your monthly payments may increase. If property prices fall, you could also end up owing more than your home is worth .

Home improvement loan calculator

It’s important to plan carefully and fund home improvements in the most affordable way. You want to make sure any expensive work done adds lasting value. Some improvements will increase your home’s potential and add value to your property, but not all will. For example, a loft conversion could add value by giving you extra living space, whereas some DIY projects may not.

If you're registered for online banking, you can start your application right away. Get a Personalised Loan Quote and see the interest rate and terms you may be offered, without affecting your credit rating. Please use the calculator or theloans interest rate tablefor more details. Representative 4.9% APR for loans between £7,000 and £15,000. If you can, try and use savings to help fund your home improvements. That way, you can reduce the amount you have to borrow, and how much interest you’ll pay.

Things to know about our home improvement loans

9 To become an HSBC Private Banking customer, you must be invited and reviewed on an individual basis. 3 Must have principal residence in the United States, U.S. Citizenship or Permanent Residency to qualify for closing cost credit. For more information, please contact your mortgage professional. Interest rate may increase per the terms stated in your adjustable rate note.

Pay for vehicle repairs with a personal loan, your credit card or, if you can repay the loan quickly, an arranged overdraft might be the solution. Use your credit card, top up your mortgage or take out a personal loan to finance your wedding. The highest illustrative APR for HSBC personal loans is 21.90% if you borrow between £1,000 and £2,999.

From modest home improvements to extensive building work, the cost will vary depending on what you’re looking to do. It’s important to compare quotes from reputable traders and suppliers to get the best value for money. Here, we look at how home improvement loans work and some things to consider.

The maximum amount you may borrow is subject to your financial status, and to further approval by your branch. 7 year repayment period applicable to all loans of €10,000 and over. All other loans repayable over a maximum period of 5 years.

Your property acts as ‘security’ for the lender, which means they can repossess and sell the property if you were unable to meet the loan repayments. For this reason, interest rates are typically lower for secured loans, and you could potentially borrow more. You can apply for a personal loan to cover your moving costs, or you can put them on your credit card. Moving costs could include solicitor’s fees, transport costs and stamp duty. Annual Percentage Rate quoted is based on reducing rate which is fixed throughout the loan tenor, and is inclusive of 1% arrangement fee amortized over the maximum loan tenor of 48 months.

Learn more about HSBC’s Preferred Mortgage and view rates. A great choice if you want to establish a stable mortgage budget throughout the life of your loan. By availing the loan, you shall be deemed to have accepted these terms and conditions herein in totality. HSBC reserves its absolute right to withdraw or alter any of the terms and conditions at any time without prior intimation.

Whether it's to satisfy a need or provide a luxury at some point, we all need to borrow money. A loan is subject to formal credit approval with HSBC. © The Hongkong and Shanghai Banking Corporation Limited, India . Incorporated in Hong Kong SAR with limited liability. Up to 1% fees on amount above 25% of the SCF sanctioned amount.

To be eligible for HSBC Home Loan Package, you must have minimum borrowings of $150,000 and pay the annual package fee of $390. The package fee will be deducted from the loan proceeds at settlement, and charged to the package home loan on the first business day of the loan anniversary month. If you borrow between £7,000 and £15,000 HSBC have a 3.1% representative rate until November 2021.

No comments:

Post a Comment